Private Hospital Facts

The Australian Private Hospitals Association (APHA) compiles PH Facts based on annual data. It is updated as authoritative facts, figures, trends and research about private hospital activity and the issues facing the sector are published, citing fully attributed data from independent sources.

It is designed as a fast reference to national and state-by-state information about Australia's private hospitals. The APHA has commissioned new research to provide a more comprehensive picture, expected in the second half of 2025. Scan key categories about private hospitals via the section titles in the menu (right of this page) or by scrolling below.

Scope of Activity

Private hospitals in Australia are fundamental to overall health care delivery, with the complementary nature of the public and private hospitals systems negating the polar extremes of the dysfunctional NHS in the UK and private insurance dominated US system. It is why the Australian hospital system has been considered the best in the world...

In 2025 there are 633 private hospitals in Australia, including day surgeries. This is down from the 641 in 2020. While the overall figure points to a decline of 8, in reality 82 hospitals have closed over that time.

Of the 633 hospitals open today, just 559 were open in 2020. The trend has been for day surgeries, usually doctor owned, to open, so there has been a significant shift in the make-up of the sector.

- - Comparing Private hospital second-tier category list, Department of Health and Ageing, August 2020; and the List of declared hospitals, Department of Health, Disability and Ageing, at July 2025.

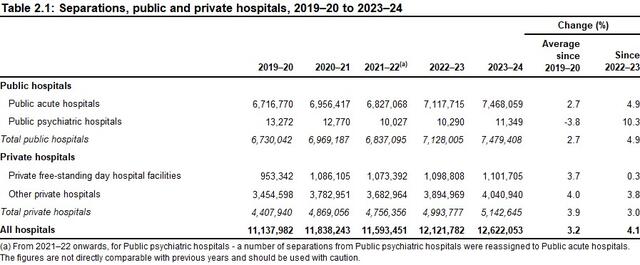

In 2023-24 private hospitals in Australia admitted 5,142,645 patients - an increase of 3% on the previous year. Private hospitals account for 41% of all hospital admissions in Australia.

Overnight stays increased by 22,258 to 1,330,167 admissions, while same day admissions increased by 126,610 to 3,812,478.

Increases were experienced across all states (noting data from Tasmania, the ACT and NT is not available).

- - Admitted Patient Care 2023-24, Section 2, How much activity was there?, Australian Institute of Health and Welfare, May 2025.

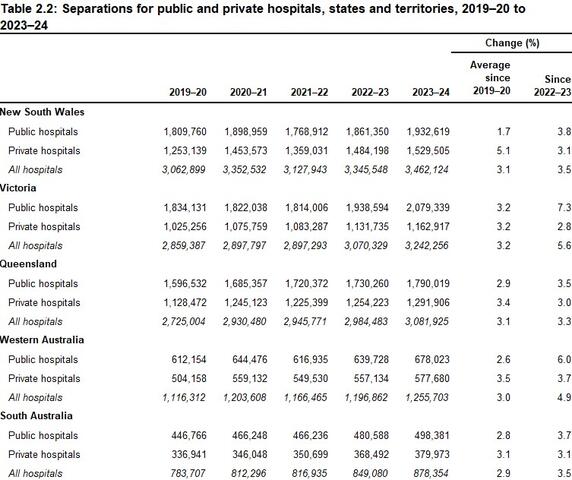

The following table shows private hospital and public hospital admissions on a state-by-state basis from 2019-20 through to 2023-24. Over the last 12 months, private hospitals accounted for the following percentage of total admissions in each jurisdiction:

- New South Wales - 44.2%

- Victoria - 36%

- Queensland - 42%

- Western Australia - 44.2%

- South Australia - 43.2%

(Note: data is not available for Tasmania, the ACT and NT).

- - Admitted Patient Care 2023-24, Section 2, How much activity was there?, Australian Institute of Health and Welfare, May 2025.

Total patient days increased from 10,415,109 to 10,594,195 - an increase of 179,086. This trend was observed across all states (noting no data is available for Tasmania, the ACT and NT).

- - Admitted Patient Care 2023-24, Section 2, How much activity was there?, Australian Institute of Health and Welfare, May 2025.

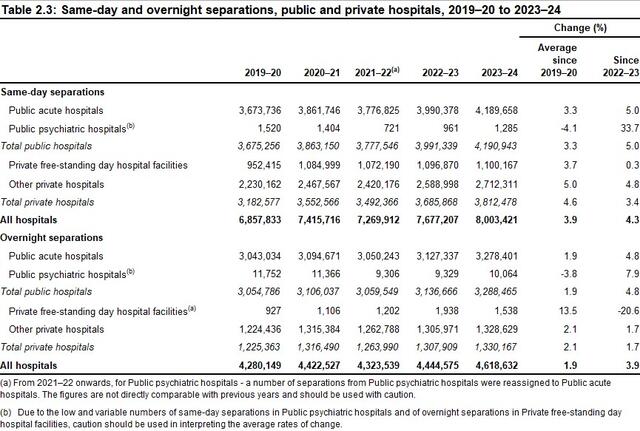

In the 12 months to 2023-24, there were 3,812,478 same day admissions in private hospitals (an increase of 3.4% on the previous year), with 1,330,167 overnight admissions in the same period (an increase of 1.7%).

Same day separations as a percentage of the total admissions for private hospitals amount to 74.1%.

- - Admitted Patient Care 2023-24, Section 2, How much activity was there?, Australian Institute of Health and Welfare, May 2025.

Elective surgery admissions in private hospitals increased to 4,113,025 (up from 3,996,254) in 2023-24, while emergency admissions in private hospitals rose to 247,909 (up from 243,932 on the previous year).

- - Admitted Patient Care 2023-24, Section 4, Why did people receive care?, Australian Institute of Health and Welfare, May 2025.

Of the Emergency Department admissions in private hospitals over 2023-24, they were funded as follows:

- 43,328 - via private health insurance.

- 993 - public patients.

- 1,032 - self-funded.

- 1,322 - funded by the Department of Veterans' Affairs.

As a side note: Private health insurance funded 54,412 Emergency Department admissions in public hospitals.

- - Admitted Patient Care 2023-24, Section 6, What procedures were performed?, Australian Institute of Health and Welfare, May 2025.

Across the total admissions to private hospitals over 2023-24, they were funded as follows:

- 4,203,282 - via private health insurance.

- 309,157 - were public patients funded by the states/territories.

- 362,389 - self-funded.

- 133,441 - funded by the Department of Veterans' Affairs.

- - Admitted Patient Care 2023-24, Section 4, Why did people receive care?, Australian Institute of Health and Welfare, May 2025.

Over 2023-24 there were 3,312,121 acute same day admissions and 1,192,256 acute overnight admissions in Australian private hospitals - an overall increase of 112,755.

- - Admitted Patient Care 2023-24, Section 4, Why did people receive care?, Australian Institute of Health and Welfare, May 2025.

Surgical

Private hospitals account for a staggering 70% of all planned surgery in Australia - 1.83 million operations a year. Not only providing the latest procedures and technologies to private patients in state-of-the-art facilities, but taking massive pressure off the public hospital system...

Private hospitals perform most of many of the life-saving and life-changing procedures Australians need throughout their lives:

- 95% - Obesity and Overweight

- 77% - Skin Grafts

- 76% - Coronary Procedures

- 75% - Knee Replacements

- 74% - Hip Replacements

- 72% - Eye Disorders

- 69% - Malignant Skin Cancers

- 66% - Carpal Tunnel Syndrome

- 65% - Spinal Disorders

- 63% - Hernias

- 53% - Malignant Breast Cancers

- - AR-DRG - Operating Room and Major Diagnostic Category 2023-24, Australian Institute of Health and Welfare, 2025.

In 2023-24 private hospitals performed 1,827,599 surgeries, including 48,344 via Emergency Department admissions.

- - Admitted Patient Care 2023-24, Section 6, What procedures were performed?, Australian Institute of Health and Welfare, May 2025.

Of the elective admissions involving surgery in private hospitals over 2023-24, they were funded as follows:

- 1,371,056 - via Private health insurance.

- 59,718 - public patients.

- 131 - self-funded

- 32,415 - funded by the Department of Veterans' Affairs.

- - Admitted Patient Care 2023-24, Section 6, What procedures were performed?, Australian Institute of Health and Welfare, May 2025.

Medical

Often forgotten, private hospitals perform 1.66 million medical treatments every year, often involving interventions Australians need every day...

Private hospitals are major providers of critical medial treatments, often including interventions relied on by Australians every day:

- 86% - Dental Extractions and Restorations

- 83% - Retinal Interventions

- 74% - Lens Interventions

- 73% - Gastroscopy

- 69% - Spinal Disorders (non-surgical)

- 66% - Sleep Apnea

- 61% - Female Reproductive Disorders

- 60% - Male Reproductive Disorders

- 54% - Chemotherapy

- 53% - Ear, Nose and Throat Diseases

- - AR-DRG - Major Diagnostic (Medical) Category 2023-24, Australian Institute of Health and Welfare, 2025.

Private hospitals treated 1,666,305 patients for medical conditions in 2023-24, continuing a steady rise since 2019-20.

- - Admitted Patient Care 2023-24, Section 5, What services were provided?, Australian Institute of Health and Welfare, May 2025.

Mental Health

Australia's private acute psychiatric hospitals provide services for patients suffering from moderate-to-severe mental health issues. They complement the public psychiatry hospital system, which treats a different caseload mix - meaning they are not interchangeable, nor do community clinics and out-patient services meet the same acute needs...

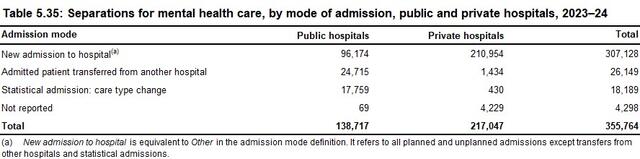

Over 2023-24 private acute psychiatric hospitals accounted for 61% of all acute mental health admissions - a decline of 1% to 217,047 (down from 217,851 the previous year).

- - Admitted Patient Care 2023-24, Section 4, Why did people receive care?, Australian Institute of Health and Welfare, May 2025.

Across the mental health admissions in private hospitals for 2023-24, total separations encompassed:

- 1,084,846 - patient days, with an average length of stay being five days.

- 167,483 - specialised psychiatric care days.

- 179,933 - total admissions funded by private health insurance (83%).

- - Admitted Patient Care 2023-24, Section 5, What services were provided?, Australian Institute of Health and Welfare, May 2025.

Rehabilitation

Australia's private rehabilitation hospitals cover a wide array of needs, including recovery from traumatic physical and brain injuries to drug and alcohol recovery programs...

There are 35 designated rehabilitation private hospitals in Australia*. Within the APHA membership, there are 54 hospitals providing various levels of rehabilitation services**.

- - *Deptartment of Health, Disability and Ageing, List of declared hospitals, July 2025;

- **Australian Private Hospitals Association, Membership Data, July 2025.

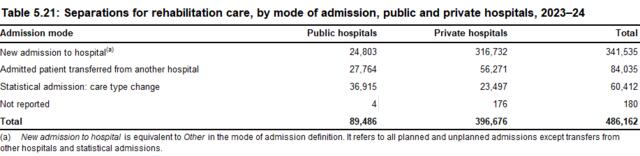

81.5% of all admissions for rehabilitation hospitalisations in Australia are in private hospitals. In 2023-24 admission rose by 36,958 to 396,676 total admissions.

- - Admitted Patient Care 2023-24, Section 4, Why did people receive care?, Australian Institute of Health and Welfare, May 2025.

Of the total admissions in private rehabilitation hospitals in Australia, they were funded as follows:

- 361,090 - via private health insurance.

- 5,003 - were public patients funded by states/territories.

- 3,195 - self-funded.

- 13,414 - funded by the Department of Veterans' Affairs.

- - Admitted Patient Care 2023-24, Section 5, What services were provided?, Australian Institute of Health and Welfare, May 2025.

Maternity

Despite mothers-to-be showing an overwhelming preference for private hospital deliveries - encompassing a full suite of care throughout pregnancy, birth and puerperium - the proportion of private births is plummeting...

Over the decade to 2023-24, the proportion of births in private hospitals has fallen from 30% of total births to just 20%.

In the last year total births in private hospitals fell to 61,618 (down from 64,200 in the previous year).

- - Births, Australia, Australian Bureau of Statistics, 2025.

Australia is experiencing an historic fall in births. There were 286,998 births registered in 2023, with declines across all states and territories. There has been an 5.68% fall (a drop of 17,270 births) in birth rates since 2015-16.

- - Comparing data from Australia's mothers and babies 2015, Australian Institute of Health and Welfare, (released 2017); with Births in Australia, Australian Institute of Family Studies, December 2024.

In a recent research article, published in the Medical Journal of Australia, a study found that:

"Our preliminary modelling is predicting that the number of births occurring in Australian private maternity hospitals are likely to fall precipitously. So quickly that, by the end of the decade, private maternity hospital will cease to exist."

- - See MJA article at: Private maternity hospitals: extinct by the end of this decade?, July 2024.

Over the last decade, 14 private hospital maternity wards have closed (including two hospitals which closed entirely).

- - See story at: Why HealthScope maternity closures are an 'absolute crisis' and a symptom of a bigger problem, Australian Broadcasting Corporation, February 2025.

The fall and possible elimination of private maternity services does not bode well for the state of maternity care generally. A 2025 Monash University study revealed that:

"Baby deaths were 53% higher, stillbirths were 56% higher and death soon after birth was 48% higher in multiprofessional public care versus obstetric-led continuity-of-private care".

- - Maternal and Neonatal Outcomes and Health System Costs in Standard Public Maternity Care Compared to Private Obstetric-Led Care: A Population-Level Matched Cohort Study, Professors Emily Callander and Helena Teede, Monash University, July 2025.

Not only is having your baby safer in private hospitals with a continuum of care for mums and bubs, it's also cheaper. Extract from the Monash University study:

"In these 368,292 matched pregnancies/births over four years to December 2019, the standard public model had an extra:

- 778 stillbirths or neonatal deaths (0.9 versus 0.4 per cent)

- 2,301 neonatal intensive care admissions (3.5 versus 1.3 per cent)

- 3,273 women with more severe vaginal tears (2.5 versus 0.7 per cent)

- 10,627 women with postpartum haemorrhage or excessive bleeding (9.6 versus 3.8 per cent)

- $5,929 cost per pregnancy ($28,645 versus $22,757) including costs to all payers when compared to the private obstetric-led model."

The overall additional cost of the standard public system is estimated at around $400 million annually, indicating potential for cost savings with private obstetric-led care.

- - Maternal and Neonatal Outcomes and Health System Costs in Standard Public Maternity Care Compared to Private Obstetric-Led Care: A Population-Level Matched Cohort Study, Professors Emily Callander and Helena Teede, Monash University, July 2025.

The shutdown of private maternity wards could see taxpayers up for, at least, an extra $1.7 billion a year to fill the breach.

- - Maternal and Neonatal Outcomes and Health System Costs in Standard Public Maternity Care Compared to Private Obstetric-Led Care: A Population-Level Matched Cohort Study, Professors Emily Callander and Helena Teede, Monash University, July 2025.

There are many factors that make maternity care challenging. Birth rates in Australia are at historic lows. Midwives are had to come by. Having paediatricians on-call 24/7 is expensive.

Another is health insurance companies only include maternity at the Gold level of cover. Despite holding Gold cover, often for years, mothers-to-be are shocked to discover they are not covered for an obstetrician, meaning they can be up for $10,000 in out-of-pocket costs.

Noone makes margin on maternity care. It has traditionally been cross-subsidised from other areas of the hospital because it's an important local service.

But over the last three years it has become increasingly untenable. The Australian Prudential Regulation Authority reports that health insurance companies have banked record profits of over $5 billion during that time. They also rake in $3.5 billion a year in 'management fees'.

Yet, over those three years they short-changed private hospitals by more than $3 billion on the treatments and care they provide. It can come as no surprise to anyone that this is unsustainable. If left unaddressed, more services, indeed, entire hospitals, will close.

So whether you have more babies to deliver or extra staff to deliver them, when you're being underpaid for the services you provide, then delivering 100, 1,000 or 10,000 babies each year doesn't help. In fact, you are just compounding the funding shortfall.

- - APHA summation of the issue.

Economy

In addition to being an indispensable part of Australia's health landscape, private hospitals are major drivers of economic activity and jobs...

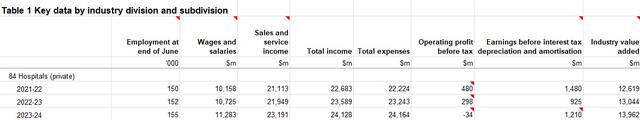

Australia's private hospitals generated $24.128 billion last year in direct economic activity - an increase of $539 million on the previous year.

- - Australian Industry Data, Table 1 Key Data By Industry, Australian Bureau of Statistics 2023-24, May 2025.

However, the modest rise in income was outstripped by higher expenses over 2023-24 to $24.164 billion - up $921 million on the previous year.

- - Australian Industry Data, Table 1 Key Data By Industry, Australian Bureau of Statistics 2023-24, May 2025.

The gap between income and costs in 2023-24 (as stated above), saw the private hospitals record a sector-wide loss of -$34 million for the year.

- - Australian Industry Data, Table 1 Key Data By Industry, Australian Bureau of Statistics 2023-24, May 2025.

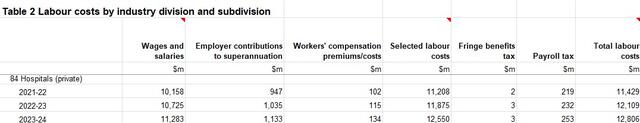

Private hospitals paid $12.55 billion in labor costs for staff in 2023-24, up $675 million on the year before, while only employing an additional 3,000 people on the previous year.

- - Australian Industry Data, Table 2 Labor Costs By Industry, Australian Bureau of Statistics 2023-24, May 2025.

In 2023-24 private hospitals employed 155,000 Australians - up 3,000 on the previous year - including nurses, allied health care professionals like radiographers and physiotherapists, as well as orderlies and administration staff.

- - Australian Industry Data, Table 1 Key Data By Industry, Australian Bureau of Statistics 2023-24, May 2025.

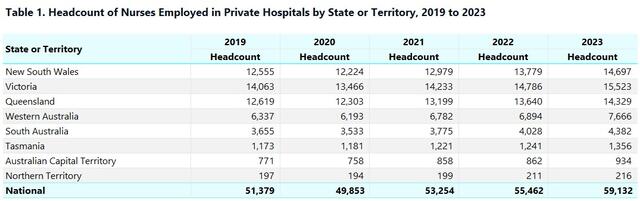

In 2023 Australian private hospitals employed 59,132 nurses - a 6.2% increase on the previous year. The state-by-state breakdown on nurses employed follows:

- - Private Hospital Nurses by State or Territory, Department of Health, Disability and Ageing, July 2025.

The Australian Government's Private Hospital Viability Health Check, released in November 2024, showed that almost one-third of private hospitals are operating at ongoing losses. Of the remainder, most are simply breaking even. Just a few are operating at a profit, but this is only at margins of 1-2%.

To put this is context, a research report by Ernst & Young in 2024 found that hospitals need a minimum 5% return in order to invest in the technologies, procedures and services expected of them. Further complicating this financial crisis, banks will not lend to hospitals when returns are below 10%.

- - Private Hospital Viability Health Check, Australian Government Department of Health and Ageing, November 2024.

Private Health Insurance

Let's be clear. There has always been argy-bargy between hospitals and health insurance companies, but what has emerged from the insurers over recent years is something not seen before - rapacious profiteering, gouging of insured people and record and growing short-changing of healthcare providers. The 12.5 million Aussies with private hospital cover are paying more and more to insurers, but getting less and less for it...

Since 2022 private health insurance companies in Australia have recorded unprecedented profits, a remarkable feat given annual premium increases have been historically low (3% or less each year).

The after-tax profits of health insurance companies in Australia for the 12 months ending June 30 each year

- 2021-22 - $1.051 billion.*

- 2022-23 - $2.187 billion.**

- 2023-24 - $1.846 billion.***

- - *Quarterly private health insurance statistics June 2022 (released 24 August 2022) page 10,

- **Quarterly private health insurance statistics June 2023 (released 23 August 2022) page 10,

- ***Quarterly private health insurance performance statistics, Key metrics, September 2023 to June 2024 quarters (released 28 February 2025), Australian Prudential Regulation Authority.

On top of the record profits over recent years, the private health insurance industry increased its 'management fees' charged to customers in 2023-24 by a massive 18% - reaping another $3.5 billion a year from premiums.

- - Quarterly private health insurance performance statistics, Key metrics, September 2023 to June 2024, Australian Prudential Regulation Authority, August 2024.

In December 2024, the Commonwealth Ombudsman lifted the lid on phoenix policies. This loophole-exploiting practice sees health insurers scrap existing products, replace them with identical or near-identical services and sell them at much higher premiums.

At the time, Federal Health Minister Mark Butler publicly warned the insurers to stop the practice or he would legislate to block it.

But a CHOICE Magazine consumer investigation, released in April 2025, exposed that:

- On the same day the Minister announced average premium increases in February 2025 of 3.73%, HCF 'phoenixed' its Gold level cover.

- Over the last four years cumulative average premium increases have been 11-12%. Under the phoenix policies over the same period premiums increased by 45%.

Given the health insurers' propensity to rip-off both ends of the spectrum – gouging their members at one end and short-changing hospitals at the other – we would welcome an ACCC investigation into these health insurance practices.

It is our view that they constitute unconscionable conduct, anti-competitive behaviour, represent abuses of market power and are, clearly, contrary to the interests of consumers of private health insurance.

- - See the CHOICE article at: Insurers hiding soaring increases to top-level health cover, April 2025.

Out-of-pocket costs are a real concern for patients. There are no out-of-pocket costs for private hospitals, but there are for specialist, anesthetists and others.

Increasingly, private health insurers are selling more and more policies with exclusions and restrictions. These policies do not cover common procedures or only offer partial coverage, leading to high out-of-pocket costs.

While the number of people insured for hospital treatment has grown from 11.2 million in December 2019 to 12.5 million in March 2025, the number of people on exclusionary hospital policies has grown from 6.6 million to 8.6 million in the same period.

The percentage of hospital policies with exclusions by insurers has grown from 57.7% in December 2019 to 67.6% in March 2025.

(If concerned about exclusions or restrictions in your health insurance policy, check out the Am I Adequately Covered? materials under the Publications section of this website.)

- - Quarterly private health insurance statistics March 2025, Spreadsheet 20250529 Quarterly Private Health Insurance Membership and Benefits March 2025, Australian Prudential Regulation Authority, May 2025.

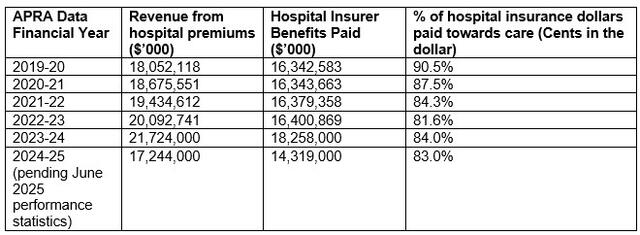

Traditionally, private hospitals would receive in the order of 88-90% of the premiums health insurers get each year. This funding ratio has been the norm. However, over recent years the insurance companies have been keeping more for themselves while failing to meet the rising costs of healthcare delivery in hospitals.

Pass through of Patient Premiums to Patient Services

- - Australian Prudential Regulation Authority, Operations of Private Health Insurers Annual Report (FY20-24), Quarterly private health insurance performance statistics.

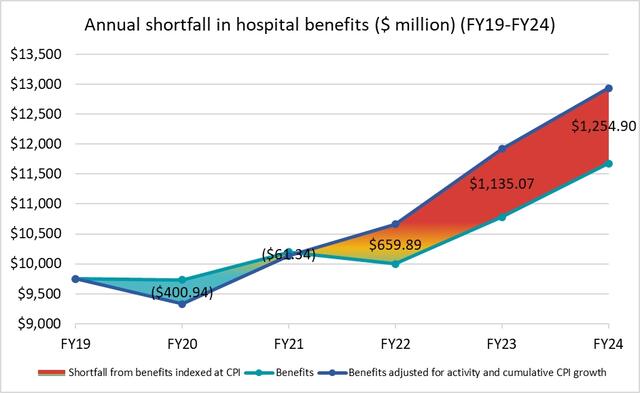

When looking at the rising cost of providing healthcare each year and the funding provided by health insurers, the shortfall in meeting the actual costs of care is stark.

As the table below shows, the underpayment to private hospitals has grown year-on-year, with a shortfall of $659.89 million (2022), blowing out to $1.135.07 billion (2023) and rising further to $1.254.9 billion in 2024.

- - Consumer Price Index, Australia, Australian Bureau of Statistics (2024); Quarterly Private Health Insurance Statistics, Australian Prudential Regulation Authority, (released August 2024).

In addition to underpayments, the health insurance industry routinely engages in underhanded and unconscionable contract negotiation tactics, including:

- take-it or leave-it contract offers – refusing to negotiate in good faith, making one offer only and then using market power to influence other parties, such as doctors, to boycott hospitals that do not comply,

- playing hospitals against one another – using information from negotiations with other and competing hospitals to force positions on hospitals,

- the imbalance in information access – hospitals in a catchment area are disadvantaged when insurers are privy to the situation, practices and caseloads of competitors,

- bundling and inclusion of penalties for referrals – imposing restrictions on one hospital operator for the post-hospital care of patients and seeking to limit clinical decisions affecting patient rehabilitation. If patients require care nonetheless, the contracted hospital is penalised,

- payment schedules – these are notoriously missed and delays of many months are typical,

- contracting delays – contract renegotiations are being delayed by months and in some cases by more than a year, meaning hospitals cannot even try to get a better deal for the costs they incur,

- failure to contract at all – some health insurers that have had longstanding contracts with hospitals have simply refused to enter into new contracts, forcing those affected insured patients to pay significant out-of-pocket expenses or go to a different hospital,

- aggressive audits – these have gone beyond the remit of insurers' rights to patient information, with insurers insisting on a patient's full medical history, not just the procedure, treatment and services involved in the admission being claimed.

Light needs to be shed on these contracting tactics, with the APHA calling on the Federal Government for a Mandatory Code of Conduct to force transparency and accountability on these practises.

- - Examples provided to the APHA by member hospitals and reported to the Federal Government for action.

![[APHA]](/images/logo_apha.svg)